On June 20, 2020, the IRS finalized tax Form 941, Employer’s Quarterly Federal Tax Return, to collect information about the new COVID-19 tax incentives, expanding the form from two to three pages, and adding 58 new data fields (previously 18 total lines). See Appendix I: Summary of COVID-19 Employer Tax Incentives for more information.

While the form 941 changes are complicated, any many taxpayers may be unprepared for the new complexity, software can simplify the process the process by automating most of the form, including all of Worksheet 1.

5 Key Takeaways

First. Taxpayers must use this version of the form for the second, third and fourth quarters of 2020. Taxpayers should use the January 2020 revision of Form 941 to report employment taxes for the first quarter 2020.

Second. If you didn’t utilize any COVID-19 benefits, complete Form 941 as you’ve always done and just ignore or leave blank the new fields.

Third. Form 941 includes new data fields to collect COVID-19 related information:

- New Lines 5a(i) and 5a(ii)were added to understand whether you paid any Qualified Sick Leave or Qualified family leave wages. Note the different 6.2% rate.

- New Line 13bwas added to report the amount of Social Security tax the employer chose to defer during the quarter, in essence, giving taxpayers an interest free loan of up to 18 months.

- New Line 13fwas added to report the total advances (if any) received for the quarter from filing Form 7200 Advance Payment of Employer Credits Due to COVID-19.

- New Lines 19 through 25were added to collect more information about the Employee Retention Credit and Qualified Health Care expenses.

- New Data Fields related to a Refundable/NonRefundable Concept (New Lines 11b-11d, 13b-13d, Worksheet 1), which is important and adds considerable complexity to the form.

Fourth. The design of the updated COVID-19 Form 941 is odd as it uses a circular approach. Entries from the end of the form Part 3 feed into new Worksheet 1, whose calculated amounts then feed back into Part 1.

Fifth. All other new data fields are Calculated Data Fields that add, subtract, multiply or compare entries.

Form 941, Part 1 Changes

Line 5a. Taxable Social Security wages. While not new, be careful with the entry. It includes total wages, including qualified wages from the employee retention credit, but it does NOT include qualified sick-leave and family-leave wages reported on new lines 5a(i) & 5a(ii).

- As historically done, businesses should stop reporting when the Social Security limit is met, which is $137,700 for 2020, but to reach this threshold, taxpayers should consider qualified sick-leave and family-leave wages reported separately.

New Lines 5a(i) & 5a(ii). Qualified sick-leave and family-leave wages (plus calculated tax).

- These have their own new line to capture their unique status of being excluded from the employer portion of Social Security tax (i.e., the tax is calculated using only the employee portion rate of 6.2%).

- These new amounts are both limited to the 2020 Social Security limit. Excess amounts are reported in Worksheet 1, Steps 2a(i) and 2e(i), not on the revised form 941 itself.

Line 5c. Taxable Medicare wages & tips. While not new, be careful with the entry. Enter all wages, including qualified sick-leave wages, qualified family-leave wages and qualified wages for the employee retention credit. Also include tips, sick pay and taxable fringe benefits subject to Medicare Tax. Unlike other entries, there is no social security limit on the amount of wages subject to Medicare Tax.

New Lines 11b to 11c & 13c to 13d. These lines report the nonrefundable portions of credits for qualified sick-leave and family-leave wages and the ERC, as calculated on new Worksheet 1. See Nonrefundable and Refundable Credits Discussion.

New Line 13b. The IRS added this new line to capture the employer share of its 6.2% of Social Security tax it elected to defer for the quarter (if any).

- Taxpayers can defer the deposits and payments, not the liability. Thus, taxpayers won’t receive a refund or credit of any amount of the employer share of Social Security tax already deposited for the quarter. In short, taxpayers cannot defer tax that they already paid. However, in determining whether any amount of the employer share of Social Security tax was already deposited for this purpose, small businesses can consider prior deposits during the quarter as first being deposited for employment taxes other than the employer share of Social Security tax. The IRS indicated amounts deposited and tagged with an identification subcategory are for informational purposes only. The IRS doesn’t use that information in comparing liabilities reported on the employment tax return and the total deposits made. Thus, small businesses are free to disregard their prior classifications.

New Line 13f. The IRS added this new line to capture the total advances received from filing Form 7200: Advance Payment of Employer Credits Due to COVID-19 for the quarter (if any). This line reports the total advances (if any) received from filing Forms 7200 for the quarter.

- Filing Form 7200 is not required. It is completely optional and can be filed multiple times.

- Form 7200 may be filed for a quarter up to the earlier of the end of the month after the end of each quarter or filing of Form 941 for the quarter.

- Caution: If you file Form 7200 after the end of the quarter, the IRS could process your 941 first. In such case, the IRS will update the amount of the credit to match its records or contact you to reconcile the difference.

Form 941, Part 3 Changes

After retaining existing questions asking if the employer’s business has closed or has stopped paying wages, the IRS added seven new data fields related to the new payroll tax incentives.

- New Line 19is used to report the qualified health-plan expenses allocable to qualified sick-leave.

- New Line 20is used to report the qualified health-plan expenses allocable to family-leave wages.

- New Line 21is used to report the qualified wages for the ERC.

- New Line 22is used to report the qualified health-plan expenses allocable to wages reported on the ERC.

- New Line 23 is used to report the credit from Form 5884-C, line 11, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veteran.

- New Line 24 is used to report the qualified wages paid March 13 to March 31, 2020, for the ERC; only to be used for 2020 2Q; and

- New Line 25 is used to report the qualified health-plan expenses allocable to wages paid March 13 to March 31, 2020, for the ERC; only to be used for 2020 2Q.

For these seven new data fields, the IRS doesn’t provide any data checks to ensure entries are reasonable. In the instructions, the IRS briefly describes the entry and then relies on the taxpayer to research/understand the law. While the IRS provides only limited guidance in lines 19-25, and doesn’t provide any data checks to ensure entries are reasonable, the IRS does provide more robust discussions earlier in the instructions (e.g., See line 5a(i), 5a(ii), 11b, 11c) and has a wealth of additional information on its website.

Nonrefundable and Refundable Credits

To facilitate accurate reporting, the IRS bifurcates the credits into a refundable and nonrefundable portion. The nonrefundable portion of the credit is still a credit, and it offsets the employer’s Social Security tax. The form is designed to reduce any employer Social Security tax to zero first, and then any excess COVID-19 Credit becomes refundable. Thus, the “nonrefundable” portion of the COVID-19 Credit is the amount used to offset the employer’s share of Social Security tax. The excess is the “refundable” portion.

The reduction of the employer Social Security tax follows an order: 1) Small Business Research Credits on Form 8974, 2) Work Opportunity Tax Credit (WOTC) on Form 5884-C; 3) Qualified Sick and Qualified Family Leave Credits; and 4) Employer Retention Credit (ERC).

The Research and WOTC credit can only reduce the employer share Social Security tax to zero, and excess credits carry to the next quarter. In contrast, if there is not sufficient employer social security to reduce the Qualified Sick and Qualified Family Leave Credits and/or ERC (the COVID-19 Credits) to zero, the excess amounts do not carry to a subsequent quarter. Rather, any excess amount of these COVID-19 Credits gets refunded (via new Form 7200 or by filing Form 941).

Worksheet 1: Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit

The IRS created Worksheet 1 to help users determine the refundable/nonrefundable portion of the new COVID-19 Credits. It is not filed, but kept in your records.

While the Worksheet looks intimidating, most of the lines can be auto-populated based on information already entered in Form 941. The worksheet itself only requests four new, typically uncommon entries as follows:

- Worksheet 1, line 1e.This entry only applies to Third-Party Non-Agents who split sick pay payroll responsibilities with the actual employer. In such situation, the entry captures the employer portion of Social Security tax when the Third-Party Non-Agent needs to make a Line 8 sick pay adjustment.

- Worksheet 1, line 1g.This entry only applies to employers who received a Section 3121(q) Notice and Demand during the quarter. In such situation, the entry captures the employer share of Social Security from the Notice.

- Worksheet 1, line 2a(i).This entry applies when an employer pays qualified sick pay (under the COVID-19 legislation) to employees who have met the 2020 Social Security wage limit of $137,700. This entry captures the excess amount of qualified sick pay.

- Worksheet 1, line 2e(i).This entry applies when an employer pays qualified family leave pay (under the COVID-19 legislation) to employees who have met the 2020 Social Security wage limit of $137,700. This entry captures the excess amount of qualified family leave pay.

After Worksheet 1 is completed, four lines are moved back into Form 941, Part 1:

- Line 2j: Nonrefundable portion of credit for qualified sick and family leave wages is entered on Form 941, Part 1, line 11b.

- Line 2k: Refundable portion of credit for qualified sick and family leave wages is entered on Form 941, Part 1, line 13c.

- Line 3j: Nonrefundable portion of employee retention credit is entered on Form 941, Part 1, line 11c.

- Line 3k: Refundable portion of employee retention credit is entered on Form 941, Part 1, line 13d.

As noted, this COVID-19 version of Form 941 is circular. This step allows you to finalize the form.

Form 941, Schedule B

Semiweekly schedule depositors must account for nonrefundable COVID-19 credits claimed on lines 11a, 11b, and 11c when reporting their tax liabilities on Schedule B.

Failure to account for them may cause Schedule B to report more than the total tax liability reported on line 12 (creating an error).

For reporting, the credit may be taken to the extent of the employer share of social security tax on wages associated with the first payroll payment, and then to the extent of the employer share of social security tax associated with succeeding payroll payments in the quarter until the credit is used. [The payroll tax credit may not be taken as a credit against income tax withholding, Medicare tax, or the employee share of social security tax.]

However, the employer shouldn’t reduce its daily tax liability reported on Schedule B below zero. In addition, the reporting follows an order: 1) Small Business Research Credits on Form 8974, 2) Work Opportunity Tax Credit (WOTC) on Form 5884-C; 3) Qualified Sick and Qualified Family Leave Credits; and 4) Employer Retention Credit.

Any credit that is remaining at the end of the quarter because it exceeds the employer share of social security tax for the quarter is claimed as a refundable credit (line 13c for qualified sick and family leave wages and line 13d for the employee retention credit). For additional information, See Form 941, Schedule B Instructions.

Other Comments on the Form

While Form 941 has exploded with 58 new data fields (i.e., Form 941 has 20 new data fields, plus an additional 38 data fields in Worksheet 1), the calculation is very mechanical.

To simplify the process, PayMe/TaxMe automated the process. Just answer 15 fact-based questions, and we auto-populate the other 43 new fields (including all of Worksheet 1, which you can view in the downloaded forms). Easy. Accurate. Secure.

If you need to e-file Form 941, don’t wait.

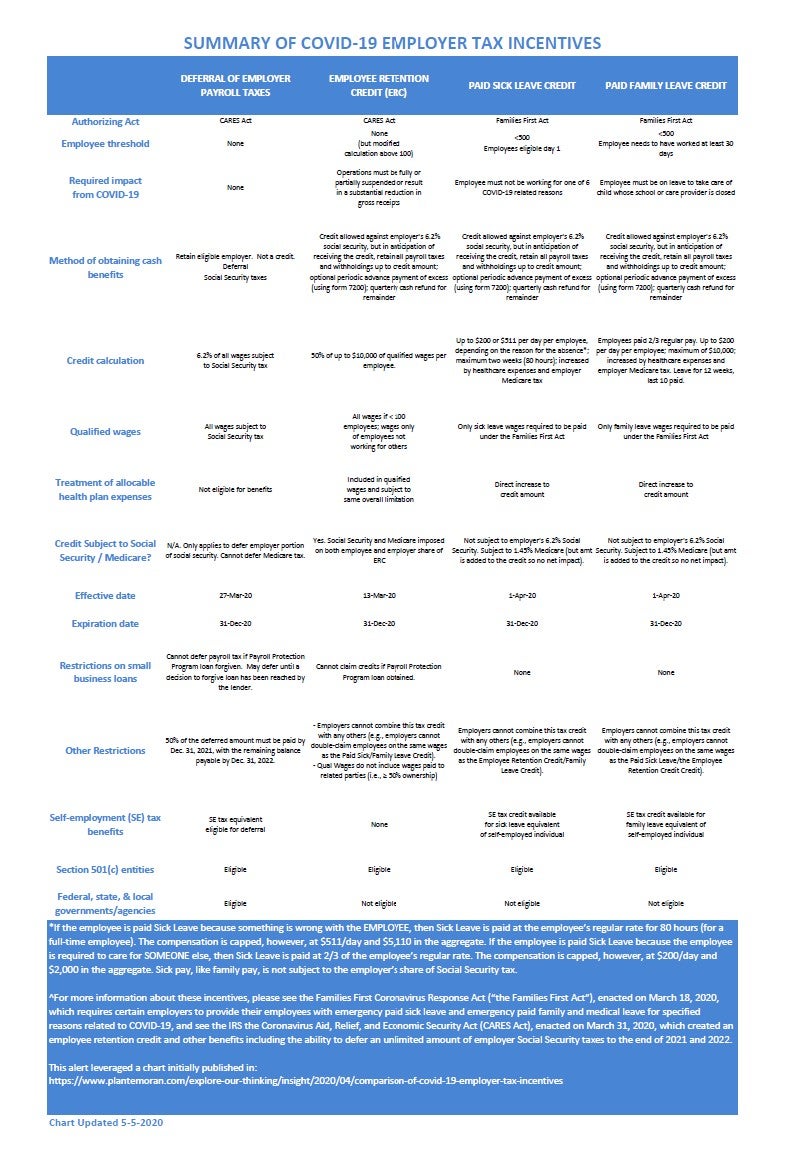

Appendix I

To help small businesses through the COVID-19 pandemic, in the Spring 2020, the government enacted the Families First Coronavirus Response Act (Families First Act) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The relevant payroll tax provisions in each piece of legislation run through Form 941 and include:

- Deferral of Employer Payroll Taxes: Deferral of an unlimited amount of employer Social Security taxes to the end of 2021 and 2022.

- Employee Retention Credit (ERC): A maximum $5,000 per employee refundable payroll tax credit for certain employers that retain employees.

- Paid Sick Leave Credit: A refundable payroll tax credit equal to all payments of the new required sick leave.

- Paid Family Leave Credit: A refundable payroll tax credit equal to all payments of the new required family leave.

The payroll credits have three main benefits:

- They are fully refundable,

- Despite the language in the legislative text that states the credits may only reduce an employer’s share of Social Security taxes, the IRS will allow the credits to reduce not only the employer’s AND the employees’ share of both Social Security and Medicare, but also the employees’ federal income tax withholding, and

- The IRS will not require a business to wait until it files its payroll tax return to claim the credits. Instead, the business may reduce its current payroll tax obligation by the amount of the anticipated credits.