Affordable Care Act (ACA) compliance and reporting is complex and very different from other federal regulatory requirements. If you are an Applicable Large Employer (ALE) with 50+ full-time employees (or full-time equivalents), receiving an ACA penalty for noncompliance will be costly, often tens or hundreds of thousands of dollars.

It is prudent to seek experienced help with your response. If you have made a good-faith effort to comply but received an unexpected or larger than expected penalty, you may be able to contest your 226-J letter.

Understanding Letter 226-J

Letter 226-J is the IRS notification of an assessed Employer Shared Responsibility Provision (ESRP) penalty for ACA violations. The 226-J will include:

- Tax Year of the 4980H violation, contact information, and the response deadline at the top of the letter

- A penalty amount with written explanation

- An itemized ESRP summary table with explanation

- Form 14764 – for your response, including whether you accept or disagree with the penalty

- Form 14765 – the Employee Premium Tax Credit Listing, which indicates your employees’ reported 1095-C information and months where penalties were assessed

Types of Section 4980H violations

4980H has two types of penalties, sometimes referred to as the sledgehammer and the tack hammer.

- A Section 4980H(a) violationoccurs if you did not offer affordable, qualifying coverage to at least 95% of your full-time employees. If you did not meet that threshold, the $2,700 penalty (indexed each year) is multiplied by the total number of full-time employees. For 2021, that means if you had 41 full-time employees and only offered 38 of them qualifying coverage, you would incur a six figure “sledgehammer” penalty.

- A Section 4980H(b) violationis triggered when you 1) do not offer qualifying coverage to a FT employee, 2) the employee enrolls in coverage on the exchange, and 3) the employee receives the Premium Tax Credit on their tax return. The Section 4980H(b) penalty is higher on a per-employee basis ($4,060 with yearly adjustments), but unlike the multiplier of the type Section 4980H(a), it only applies to that employee and is prorated only for the months of violation.

Good-Faith Effort

“You can receive a penalty notice even if you’ve done everything right!”

It’s not uncommon for a company to make every effort to comply but still incur a penalty. Penalties can result from errors or misunderstanding the forms and codes, rather than simply a lack of compliance. In addition, you can receive a penalty notice even if you’ve done everything right! We often see cases where an employee has claimed the Premium Tax Credit on their return—after all, who doesn’t want a tax credit, right? When this happens, the 226-J is automatically triggered and the company will receive the dreaded news 18 months later, where the onus to respond and confirm their compliance falls completely on the company.

Companies that completely neglected to file can do so retroactively, but may incur late filing fees even if no offers of coverage were missed.

Reporting errors can be corrected in the Letter 226-J response and some penalties could be drastically reduced. If you have ignored the coverage requirements of the ACA, the best course of action you have is to make sure you haven’t over-reported your number of full-time employees. In other words, make sure you aren’t stuck with penalties for employees who weren’t full-time or were possibly only full-time for part of the year.

Avoiding Penalty Notifications

Effective data management is crucial to ensuring both accuracy and compliance with the ACA.

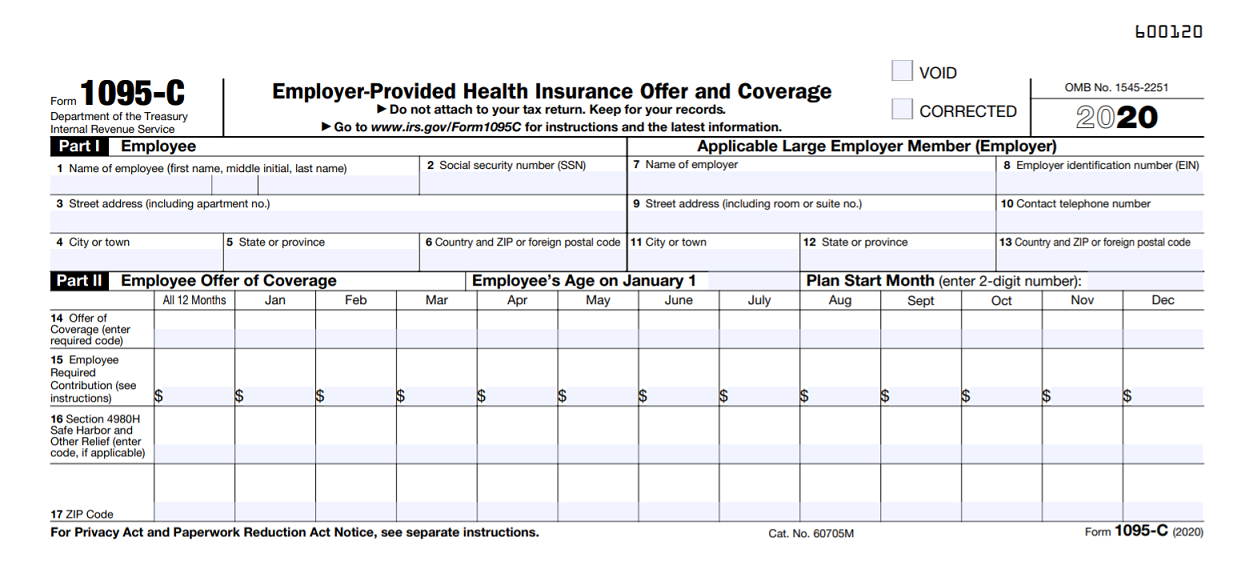

Once you have provided the required offers of coverage and ensured affordability, you must also complete and file those 1094-C and 1095-C forms with the IRS.

One common area of confusion involves Part 2 of the 1095-C.

Lines 14, 15, and 16 make up Part 2 of the 1095-C and provide details of an employer’s offer of coverage to a full-time employee. Knowing how to correctly complete this section is imperative for Affordable Care Act compliance and avoiding penalties.

Choosing a line 14 code requires you to know three things:

- Was coverage offered?

- Did it meet minimum standards?

- Was it available to the spouse and/or dependents?

Deciding on the best 1A-1S code to complete line 14 has one extra nuance, and awareness of this can save you hours of scrutiny: If a full-time employee is offered coverage and has the unconditional option to add their spouse and dependents to their plan, you may use the corresponding 1E code for all employees offered coverage—even those who are not married or do not have children. Since spouse or dependent coverage doesn’t need to meet any cost standards, there is little reason not to offer it.

With this allowance, most fully ACA–compliant companies will find they can use Line 14 code 1E for every 1095-C they submit, instead of 1B for single employees, 1C for single parents, and 1D for childless couples. Your life is already easier, isn’t it?

Line 15 – Forget about Line 14

This continues to be a very tough concept. The IRS wants to know: What is the monthly employee’s share of the least expensive, employee-only plan available to this person?

Let’s review each part of that statement.

- Employee’s share – the employee’s remaining portion after the employer’s contribution.

- Least expensive – the qualifying plan with the lowest monthly cost available, often referred to as bronze level. This is not what the employee is actually paying (for perhaps an optional, more comprehensive plan).

- Employee only – One Person. Forget that on Line 14 you reported that the offer included the spouse/dependents. For the purposes of ACA reporting, it does not matter which plan an employee actually enrolls in, only what they could have chosen and what it would have cost them.

Line 16 – What happened after Line 14?

It isn’t difficult to find that code 2C applies to employees who accept an offer of coverage, or that 2B is used for a part-time employee. Things start to get murky with code 2D. Code 2D refers to either new FT hires in a waiting period (up to 90 days), or the variable-hour employee who is in their Initial Measurement Period, also known as the Look-Back Method. Variable-hour refers to cases where it is unclear whether the new employee will be comfortably above or below the 130 hours per month full-time threshold.

People start to panic when it comes to employees who were offered insurance but declined. In their 1095-C Instructions, the IRS wrote 1181 words describing all the Series 2 Codes in use. Nowhere does it say “Use code __ if the employee declined coverage.” In cases where you have made a fully qualified offer which an employee has turned down, choose from options 2F/2G/2H based on the method being used to calculate their income which ensures offer affordability:

- Use 2F if you look at W-2 Wages

- Use 2G if you use the Federal Poverty Level

- Use 2F if you look at the employee’s Rate of Pay

Unless your company self-insures, you can bypass Part 3 completely.

Knowing how to correctly use the codes and contribution fields is fundamental, but organized tracking of ACA-related information throughout the year is equally important to save time and avoid penalties.

If you struggle to effectively manage ACA-related data year-round, you may want to consider using comprehensive IRS-Certified ACA Software (more than a forms-only filing solution) or IRS-Approved ACA Reporting Services that help you better manage employee data and offers of coverage throughout the year. Also, it may be wise to seek expert help in responding to an ACA 226-J penalty notification in order to ensure you contest the penalty appropriately.

Author: Adam Miller is an industry-recognized ACA authority and HR Manager at Passport Software, Inc., a leading provider of ACA Software with optional In-house Payroll Software, and Food Service Payroll and ACA Software, as well as ACA Management Services and Consulting. Founded in 1983, Passport Software’s goal is to help clients with the effective use of technology in order to focus on profitability and improving their business processes. Visit us on Facebook, LinkedIn, or Twitter.

Author: Adam Miller is an industry-recognized ACA authority and HR Manager at Passport Software, Inc., a leading provider of ACA Software with optional In-house Payroll Software, and Food Service Payroll and ACA Software, as well as ACA Management Services and Consulting. Founded in 1983, Passport Software’s goal is to help clients with the effective use of technology in order to focus on profitability and improving their business processes. Visit us on Facebook, LinkedIn, or Twitter.

2005 Views