Being in the corporate world comes with tons of responsibilities. From sustaining a great brand image to monitoring every financial statement, there is a lot to deal with. Among all the challenges and duties, preparing for an audit is what drives most managers crazy. It sounds like a piece of cake, but there are so many layers to this “tiny” job if you dig in deeper. You have to consider many minor areas; otherwise, the auditor may not be satisfied (which obviously is not good news for any firm).

Before we get into the details, you must know the type of audit waiting for your company. External, internal, and government audits are the three types, and you must be clear about the one that your firm is looking forward to.

Have a financial right around the corner? Great! You might want to know a few things and prepare for the day.

1. Plan it

There is no such thing as unplanned business activities, especially when it comes to audits. One small mistake can lead to significant issues and, sometimes, legal strikes as well. Start at least two to three weeks before the audit day. Do you have the right people on board? Are the financial statements in place? Begin with these two questions and enlist everything to get the audit right. Note that this audit can blow your mind, and skyrocketing growth awaits, or you can lose a lot otherwise.

2. Get your team in action

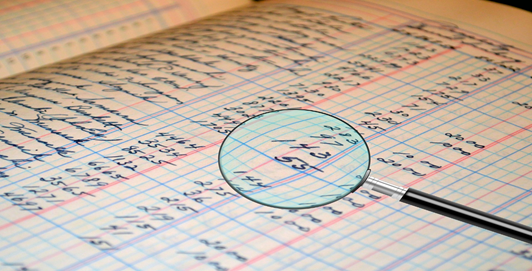

Now that you have everything listed down, get the maximum use of your team’s skills and qualifications for the audit. In case you want to help up-skill your employees for the job, a quick and flexible online master of accounting well before the big day should suffice. The finance and accounting department can significantly help you get all the financial statements verified and in place to ensure that the process goes as planned. Assign responsibilities to every one according to the auditor’s list and do not overlook deadlines here. Maximize efficiency through organizing data like:

- Fiscal year budgets

- General ledgers

- Financial statements

- Invoice and bills

- Transaction records

For instance, create groups of employees for higher productivity. You can assign the data organization duty to one group and reconciliation and regulatory requirements (discussed next) to another.

3. Catch up with the regulatory requirements

Regulatory requirements change every year. With the increasing number of fraud attempts, the laws are becoming more rigid with every passing day. What you can do is gather all the rules and regulations that apply to your firm. Now take a look at all the documents and procedures you are following. Abiding by the rules is excellent but if you fall behind, overcome it right away.

4. Never let go of the experiences

Had an audit last year that did not end up well? Don’t worry. You must have learned a lot from it, and experience is what you need this year. Recall the last audit day and look around. Are you repeating any mistakes? Improve from the previous year’s recommendations and audit notes. Be sure to avoid repeating mistakes and dodge all the consequences of a bad audit.

5. Regular reconciliations can help

You can run into reconciliation problems during the audit, but there is a way out of it. What? Regular reconciliation on your own can help you keep the issue at bay. Ask your finance team to do the job on a quarterly or yearly basis. For more accuracy, you can have weekly reconciliations.

Regular reconciliations flag problems before they become your business’s worst nightmare. They give you a chance to pay attention to minor details on time. For example, there may be a small error in one of the financial statements you overlooked before. Reconciling can help you identify that and get rid of the problem for good.

6. Handle problems on your own first

Do not give external auditors the satisfaction to flag any problems in the business. The whole point of planning and organizing is to protect your company from any embarrassment. Pinpoint problems yourself and handle them on your own before an external auditor provides you a way out of the issue.

7. Benefit from the digital miracles

The world has arguably become a global village. However, digitization comes with plenty of solutions to streamline your finance and accounting processes. Take maximum benefit from software and avoid big mistakes. Synergize human and artificial intelligence so that you have the perfect audit.

Key takeaways

To sum up, audits can be a real challenge for organizations. Combating it requires your undivided attention. As easy as it sounds, audits need a lot of planning. Unplanned audits never end up good for any firm. Always have a plan before you start. Once you have the plan intact, get your team in action and assign everyone a duty. Do not miss deadlines and schedule the entire audit as proficiently as possible. Consider all the new projects you are investing in, and keep in mind all the audit experiences you had (if any). Have you encountered a problem? Solve it right away on your own. Do not let the auditor do it for you.

2054 Views