Any organization’s financial health is largely dependent on how structured its accounting is. Hence, most organizations often concentrate their efforts on streamlining their accounting systems.

While doing so, they often settle for traditional methods of recording and processing employee-initiated expenses for pre-accounting. This could be dangerous to the financial health of your business as pre-accounting lies at the core of a comprehensive accounting process.

This article discusses the importance of streamlining and automating pre-accounting with employee expense management software in 2021.

What is pre-accounting?

Pre-accounting includes the most mundane of financial tasks. Here are some common examples:

- Collecting employee expense data

- Checking each receipt and report for any policy violations/fraudulent claims

- Processing employee expense reimbursements

- Reconciliation of credit card spends

- Documentation and safekeeping of all data in an audit-ready fashion

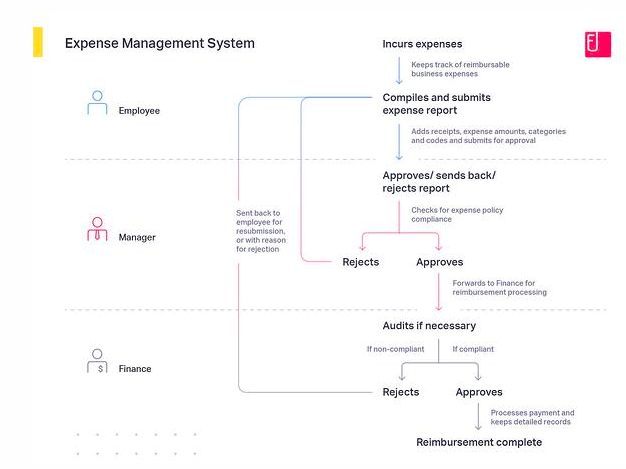

To paint a picture, here’s a typical pre-accounting workflow:

Improving the pre-accounting process is often ignored since it is not anyone’s designated job. The entire organization only plays a small role at every stage. Sadly, this is what makes it easier for inefficiencies and non-compliant claims to go unnoticed.

Common challenges of inefficient pre-accounting processes

- Inefficient employee spend management

- Suffering budget compliance

- Loss of time, money, and productive-hours

- A general lack of accountability

- Tedious employee experience

- Unpleasant audits and massive fines

To overcome these challenges, it becomes crucial for businesses to understand which of these inefficiencies are crippling their otherwise smooth, functional process. Identifying these variables plays a critical role in selecting the right solution for your business.

In a post-pandemic world, businesses often have to adapt to changing global scenarios, which affect everything from supply-chain to marketing copy. In most cases, businesses have to manage such critical process changes along with employees going remote. With changes so drastic and rapid, it becomes critical for SMBs to tweak and enforce policies and keep a close eye on employee spending.

With decentralized teams and a rapidly changing business world, SMBs need all the financial security they need. While that is a different topic, one effective way to optimize spend and keep a tight handle on budgets is to automate pre-accounting.

Standardizing and automating pre-accounting

Not closing books on time is every accountant’s worst nightmare. What’s worse is not knowing that a fractured pre-accounting process is to be blamed for it.

Traditional methods of pre-accounting could prove detrimental to the health of your business when coupled with human errors. An expense management software streamlines and automates all employee-initiated expenses in an audit-ready manner. This eliminates both human effort and error from start to end.

With an expense software, issuing cash advances, logging mileage, reconciling corporate cards, and tracking any receipts becomes effortless!

Easy business expense receipt tracking for employees

An expense management software offers employees easy ways to track and submit business expense receipts. This turns expense reporting real-time and a truly one-click process. Simultaneously, the finance team no longer needs to worry about late submissions, constant reminders, or lost receipts/expenses. In addition to real-time insights, finance teams can also gain complete control over employee spends.

Predictable automated expense approval workflows

With an expense software, you can automate predictable expense approval workflows. The software runs pre-submission checks, detects and flags duplicates, eliminates expense fraud, and drives compliant spending habits. Additionally, finance teams can configure custom approval hierarchies or apply complex workflows through policies.

This ensures compliance from the point an expense is created. Say goodbye to expense report fraud!

Real-time tracking and reporting

An expense management software helps employees track all business expenses with just a few clicks. Not only are these expenses seamlessly tracked, but they’re also policy compliant. This reduces manual intervention and errors during accounting. The prime purpose of real-time tracking and reporting is to ensure audit readiness and compliance at all times.

Real-time visibility into company-wide spending helps SMB owners and Finance and Accounting teams optimize their spending as and when required. Additionally, it also helps identify and curb unnecessary spending or overspending.

Optimize pre-accounting with expense analytics

Real-time expense analytics provide businesses with insight to continually improve their operations. As a result, businesses achieve reduced turnaround time, shorter reimbursement cycles, and more cost-savings opportunities.

With the above measures, an expense reimbursemet software automates pre-accounting and helps organizations stay audit-ready at all times.

Closing notes

SMBs might often ignore pre-accounting processes, treating them as ‘just regulatory requirements.’ However, by doing so, businesses can miss out on financial insights that could be instrumental to growth and profitability.

Today, we live in a world of paperless payments that hardly take a few seconds to be processed. It shouldn’t take your employees longer than that to submit a receipt for reimbursement.

Given how pre-accounting is painful for growing businesses, it’s evident that automation is the go-to solution. Hope this article helps you evaluate and pick the best expense management software that best suits your business needs!

2310 Views