Why has it become so difficult to safeguard credit card information? The answer lies in increasingly sophisticated technologies, most of which were created to benefit credit card users.

In the hands of ill-intentioned individuals, however, these tools enable high-tech thefts that are often difficult to prevent and detect. To protect yourself most effectively from credit card fraud, you must be aware of the many ways criminals now obtain and use their information.

Armed with this understanding, you also gain the tools you need to fight back.

Technologies that thieves use to commit credit card fraud

Criminals will go to any lengths to grab ill-gotten gains, including using the latest technologies to their advantage. Such tools include:

- Skimming devices. These mechanisms closely resemble legitimate credit card scanners, especially those provided on self-serve devices such as ATMs or gas pumps. Customers swipe their credit cards and complete their transactions, and the individual who placed the skimmer gains immediate access to their information.

- RFID readers. Cards with these embedded chips present wireless capabilities, making them easier to scan at business merchants that use “PayPass,” “Blink,” or other credit card processing systems. Although they offer greater convenience to customers, they also present easier targets for fraudsters with the right technologies.

For about $50, thieves may purchase RFID card readers, which they can then use to read consumers’ credit card information wirelessly—even through clothes or wallets—and duplicate the data on a new card, such as a repurposed hotel room key.

- Card magnetizing tools. These devices upload data (such as that obtained by a skimmer or RFID reader) and encode it onto new cards, which the thief can use to make purchases. Such fraudulent cards often remain undetected for long periods of time, especially when thieves use them for online transactions.

Although such methods might make credit card fraud seem inevitable, many measures exist to help you avoid being victimized by high-tech fraudsters. To reduce the chance of possible exposure to such techniques, consider using such safeguards as:

- Destroying RFID chips in credit cards. It may seem like an extreme move, but microwaving a credit card for three seconds (but no longer!) will “kill” the RFID card, and eliminate its ability to transmit information wirelessly. The credit card will still perform normal swiping functions.

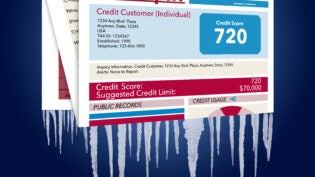

- Monitor transactions carefully. Scrutinize credit card statements thoroughly each month to ensure no suspicious transactions have occurred. Question any unfamiliar purchases, and do not hesitate to place a hold on a card that may have been compromised.

Investing in a monthly credit monitoring service can also helps to put you at ease. Some credit card companies offer such products free of charge, so check with your provider before agreeing to pay for credit monitoring.

- Change credit card numbers. The longer a credit card retains the same number, the more opportunities thieves have of finding and accessing it. Should a data breach, questionable transactions, or other circumstances raise suspicions regarding the safety of your information, request a new card number.

- Stay abreast of new high-tech protection. According to Jeff Weber of SmartBalanceTransfers.com, “Hackers have gotten so creative at stealing credit card information that it has become necessary for consumers to stay on top of these trends. Most of us wouldn’t want to give up our credit cards, so we have to stay one step ahead of these thieves.”

One device to watch is the GuardBunny, a credit card-shaped device consumers can place in their wallets along with RFID-enabled credit cards. It blocks the signal RFID readers receive, which should thwart fraud attempts. Although GuardBunny is still in development, it and other protective technologies will help consumers become as savvy as potential thieves at protecting their information.

But with the right knowledge and tools, users can successfully thwart fraudsters and enjoy greater security.

Are your credit cards safe from high-tech data theft?

3048 Views