If you are in need of cash and are considering applying for a loan, then you might want to take a step back before you actually apply for anything, and consider a few important points. Applying for a loan is a big responsibility, affecting your future credit score and credit utilisation. You may find that the loan ends up being such a burden on you and your family, and the instant gratification you got from receiving it falls to pieces later down the road. For this reason, it is important to consider the following:

You may find that the loan ends up being such a burden on you and your family, and the instant gratification you got from receiving it falls to pieces later down the road. For this reason, it is important to consider the following:

What is the loan going to be used for?

Can you afford the loan?

Is the loan for ‘good’ debt or ‘bad’ debt?

Wonga, an instant loan provider operating in South Africa, claims that considering how ‘good’ or ‘bad’ a debt is, can ultimately determine whether you should apply for it. An example of a good loan would be, if you are applying for the money to buy a car (which gets you to your job,) to pay for education (which leads to a better job in the long run and can open up new doors for you,) to pay for house repairs (this is a necessary expense and one that could cause further expenses down the line if not addressed now,) and so on. You need to judge the loan on whether it elevates your finances in the long run or lends itself to a better future for you.

Now, let’s consider what a ‘bad debt’ is. A bad debt could include things like paying out for an extravagant holiday, buying a more expensive car when your current car is working fine, buying frivolous items for yourself or your family, spending extra on Christmas treats, and so on.

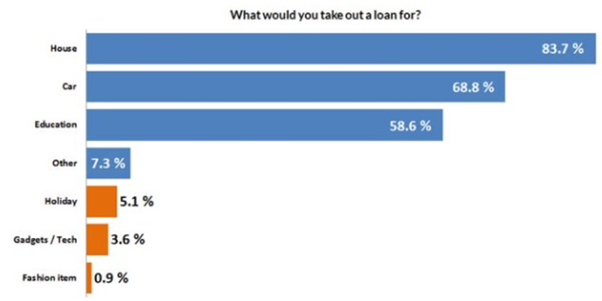

Wonga found in their financial wellness report that a large majority of South Africans surveyed aspired for better cars and luxury lifestyles. Could this be contributing towards the ‘bad’ debt? The data would appear to support this, with nearly 10% of instant loan customers confiding that they would take out a loan for a non-emergency reason such as to pay off a holiday or smartphone purchase.

Bad debt is usually something which gives instant gratification but a year later, you may have even forgotten what you spent it on. This kind of debt is simply not worth the interest, repayments and lower credit score that it will give you, despite the luxury status you believe it could obtain for you.

As important, debt can cause health implications via the stress it causes. NBC warns that stress caused by debt can heighten blood pressure, increase headaches, sleep problems and relationship issues. There is a known link between stress and health – so being informed on this is also important. Are you currently already stressed, and would this debt add or reduce that?

The other problem with ‘bad debt’ is that it is easy to accumulate. Sometimes, the urge to ‘get money fast’ overrides the sensible side of your brain that wants you to hold back and consider carefully. If you are impulsive, then you may find you have already accumulated several debts like this. This spiral can be difficult to get out of, as you end up just chasing the debt and repayments each month, giving you little breathing space. If this is the case for you, you should speak to a financial advisor who could help you consolidate debts and come up with a workable payment plan to help you get back on track.

The next area to consider is how 2021 fares when it comes to lending. Due to the pandemic, many lenders have tightened their restrictions further. It has also been harder for some people to apply for mortgages and loans – waiting times are longer as the staff haven’t been available to process paperwork, and underwriters are being much stricter about what they let through.

If you want to apply for a loan in 2021, there are still many out there, but it is important to do your research first. Check interest rates, firstly. Some may have increased which means you end up paying a lot more in the long run. You may need to be prepared to provide extra paperwork to the lenders. They may want proof that your income hasn’t been affected by the pandemic – this could mean they want many more months’ worth of payslips and bank account statements to show your financial situation is stable.

They will not want to lend money to you if they think you cannot repay it, so consider the application from their shoes – do you appear to be a reputable borrower? Do you have a good credit score? (You can check this yourself for free online,) do you have the salary to meet the repayments in full each month, and on time?

Ultimately whether you apply for a loan in 2021 or not is a decision only you can make – but being informed is a part of the process that you shouldn’t ignore. Talk to friends, family, financial advisors and see what options are out there – sometimes a different perspective can be refreshing.

2155 Views