How a Small Business Can Use Forex Trading for More Profits

By: Andrej Kovacevic

No matter what type of small business you own, you should be using, manipulating and exploiting Forex trading to increase your profits. In fact, in many cases, it is a legitimate way to increase your profits without having to increase your prices.

What is Forex Trading?

Forex or foreign exchange is a massive trading market and has its roots globally. The average trading volume of Forex trading is more than $5 Trillion. If you compare the trading volume of forex trading with all the other trading options combined, they will not reach the foreign exchange market’s potential.

Examples of People Exploiting Forex Trading

Take the candle maker who sells in batches of 50 items. When she ships to Europe from Australia, she asks to be paid in Euros, which the clients do not mind because it saves them the currency conversion fees. She knows that the exchange rate between Euros and Australian dollars can be quite volatile, so she waits a month or two to convert her Euros to Australian dollars and makes a healthier profit.

Take the example of a resume writing service. They cater to people in the US, but they accept USD, CAD, GBP, and even bitcoin. This may sound like a massive hassle for the company, but they save their money and sell it whenever the market conditions are right. In many cases, their Forex trading profits are better than their resume service profits, and it is all because they have the patience and temperament to wait for the Forex market to turn in their favor.

Who Shouldn’t Be Forex Trading

If your business doesn’t allow you to hold a certain type of currency for up to six months, then perhaps Forex trading is not for you. However, you do not have to go “All in.” For example, you may have six clients to whom you sell reusable plastic boxes. You strike a deal with one company to pay you in the currency they prefer, and you save their foreign money until the market turns in your favor. That way, only a small part of your revenue is tied up. As and when your Forex profits become healthier, then perhaps you expand a little, save a little more, and exploit the Forex markets a little more readily.

Getting Started with Forex Trading

Trading involves various complications by nature, which may explain why first-timers face so much confusion. That explains why numerous brokers are in the market to boost returns and establish beneficial trading techniques. These brokers have knowledge of the current market, and they have extensive training to grab onto opportunities.

1. Steps for Forex Trading

Start by allowing people to buy from your website with different currencies, and see which customers do. You may be surprised by how many local customers and domestic businesses prefer to pay in another currency. Once you have your stash of foreign money, you can go online and sell it for a profit.

2. Connecting the Device

When trading on your own, you need an internet connection to perform different tasks online. Furthermore, you will require an electronic device such as a computer, tablet, or smartphone. You need a reliable internet connection because if your internet fails during a transaction, you may incur a loss if the market is not in your favor.

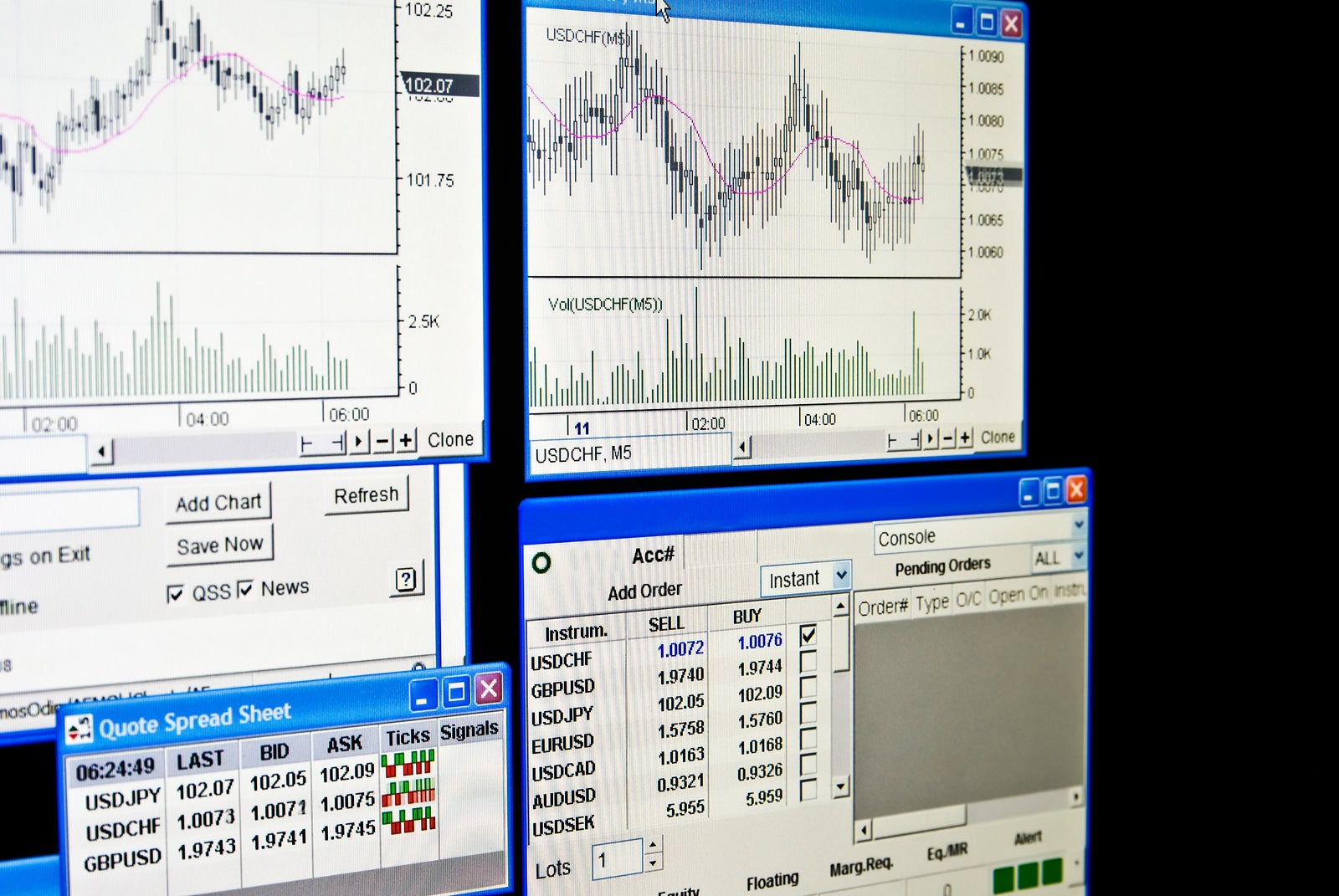

3. Finding a Suitable Platform

You will find numerous online platforms offering different benefits and features. You need to choose, depending on your requirement and strategy. The world of online trading can be overwhelming, especially when presented with the vast array of platforms, apps, and tools available. While selecting the right platform is an important first step, that decision shouldn’t stop there. For instance, tools such as MetaTrader 4 or Telegram Forex Copier can help simplify and automate the trading process, enabling you to monitor multiple markets at once and execute trades quickly with greater accuracy.

However, choosing a platform can be challenging because, with so many options, you might also encounter scams. Here are some features to consider before making a decision:

4. Security

Checking a platform’s security options is important because you need to ensure if a platform is secure enough to invest your hard-earned money. You cannot risk your money by choosing a platform that does not offer security features such as two-way authentication, or separate account to store your money, etc.

5. Deposit and Withdrawal Options

Many platforms offer unreasonable and limited options to withdraw and deposit the money on and from the platform. If the transaction method is not easy and flexible, you should not join that platform. Choosing a platform with simple and easy payment options will save precious time so you can execute your strategies without any interruption.

6. Trading Platform

If you are new to trading, you should choose a user-friendly trading platform with convenient features to understand the process easily. There is no point in choosing a platform that is too complicated for you to start trading.

7. Customer Service

You should choose a trading platform with good customer services and educational support so you can learn about using the platform and start trading as soon as possible. Many trading platforms do not mention their address or contact number. These platforms are mostly scams. A platform with appropriate location and responsive contact details are good to join.

8. Create an Account

Once you choose a platform for trading, you need to decide which trading account you will choose. Many top trading platforms offer various options depending on the features. You need to check all the accounts and decide upon the best one that suits you. Also, consider your budget before making a decision.

9. Start Trading

Once you deposit the money on the platform, you can start trading. Many platforms offer demo accounts so you can get started before you can even invest. These accounts can be free or require a little amount to get started. You can practice your trading strategies on these accounts.

There is a small degree of risk. For example, if your small business suddenly needs money quickly, you may have to sell some of your foreign money prematurely and make a loss. Otherwise, Forex trading is a great way to boost your profits while keeping your foreign (and domestic) clients happy.

Editor’s Note: Any financial information or opinions contained in this article are the author’s own and do not represent endorsement or support of any products or services by SmallBizClub.com.

2803 Views