Understanding your tax requirements as a small business owner or individual is tricky and challenging at the best of times. There are so many moving pieces and requirements – all due on different days – that it can be hard to keep it all straight!

However, there are few things more important for the long-term survival of your small business than keeping track of your tax obligations and knowing when you have payments due. Preparing and completing state and federal tax returns are essentials of small business bookkeeping.

If you feel overwhelmed but you want to handle your 2019 taxes on your own, the first thing to do is figure out the deadline to pay your taxes. Then you can work backwards to build a plan to get everything done on time.

Break it down into steps so that you can tackle one task at a time according to what you need to have turned in and when. Don’t start a business without thinking about the accounting work! The behind the scenes work can sneak up on you, and then when you reach these important deadlines, you may find yourself scrambling to get things done.

Turning Everything in on Time

Paying taxes and filing your return can be done either online or through the mail. April 15th is the day that everyone knows, and that’s the main date you need to know for your personal taxes. However, if April 15th (or any other pre-set due date throughout the year) happens to fall on a Saturday or Sunday, the actual due date becomes the next business day.

In order to meet the due date online, you need to submit your income tax return online and any final necessary payment before the end of the day on the due date. The end of the day is assessed depending on your particular time zone. You can find out how to file your return online through the IRS website.

If you file your tax return by mail, then your return needs to be addressed, adequately stamped, and postmarked by the due date. If it doesn’t meet those requirements, your tax return is not filed on time.

Credit: 1800Accountant

Business Tax Complications

Depending on the organization of your company, the due date for your corporate tax return may vary. S-corporations have a special tax status, which requires that you file an informational tax form by March 15th.

The same is true for companies organized as partnerships. Income earned through these types of business structures pass through to your individual tax payment, so the business return is required a month before your personal tax filing.

C-corporations, however, count as separate entities for the IRS, so you are required to pay taxes and file a separate return for them. This is due on April 15th, so it is the same date for all distinct, tax-paying entities.

If your business is a sole proprietorship, you only need to consider the income on your personal form 1040 due in April.

Estimated Quarterly Payments

For self-employed people, entrepreneurs, and business owners, it’s important to remember that the IRS wants you to pay your taxes at set dates throughout the year.

If you’re not paying taxes throughout the year in your business or through an employer, then you should be making estimated quarterly payments of the taxes you expect to owe.

Self-employed individuals and others making quarterly payments can use Form 1040-ES to estimate their payments.

A good rule of thumb is that you’ll owe about a fourth of what you make. You can either calculate this as a lump sum if your income doesn’t vary much throughout the year. Or you can calculate it based on your income from the last quarter.

Getting an Extension

Sometimes life circumstances get in the way and you might not be able to complete your return for federal income tax by the due date. This is particularly true if you’re a small business owner, as you may find that your business tax returns are significantly more complicated than your personal.

You should make every effort possible to stay organized and get the paperwork done promptly, as otherwise you’ll be starting out behind for the year to come.

If you know for sure that you’ll be turning your return in late, however, you can request a tax extension to give yourself a little more time. Requesting a six-month extension is an easy process. All you have to do is fill out form 4868 from the IRS. That form must be turned in before the original due date.

This will give you half a year to gather paperwork, work out your deductions, and finish filing your return. The extension only applies to the tax return itself. All of your tax payments for the year are still due by the original deadline.

If you also foresee struggling to pay the tax balance you owe, you can request to pay the rest in installments with IRS form 9465. If you have other questions around due dates, you can look for Publication 509 from the IRS for details.

Special Circumstances

There are special tax deadline rules for individuals serving overseas in the military or holding foreign financial accounts. If a taxpayer is serving in the military and stationed overseas or deployed to a combat zone, they are not subject to the normal deadline. They should have at least 180 days after leaving their post to finish filing their taxes.

If you own accounts in foreign countries that added up to a value of over $10,000 at any point during the 2019 calendar year, you will also need to file for those accounts with form 114a. That return is due by April 15th, the standard personal tax deadline.

Taxes on foreign investments can be very complicated, and getting professional help is recommended if this is a concern for you or your business.

Penalties

If you turn in your tax return late without asking for an extension, be prepared to face filing penalties added on to the final amount you owe. These fines increase depending on how long it takes you to finally complete your filing.

The same thing will occur if the IRS determines that you were late to pay any of the taxes you owed during the calendar year. These fines will be taken first out of any tax refund you would otherwise have received, and then any extra will be charged to you directly.

You can avoid all common IRS penalties by filing and paying promptly by each deadline and ensuring that all payments and files go through successfully.

When Are Taxes Due for Individuals?

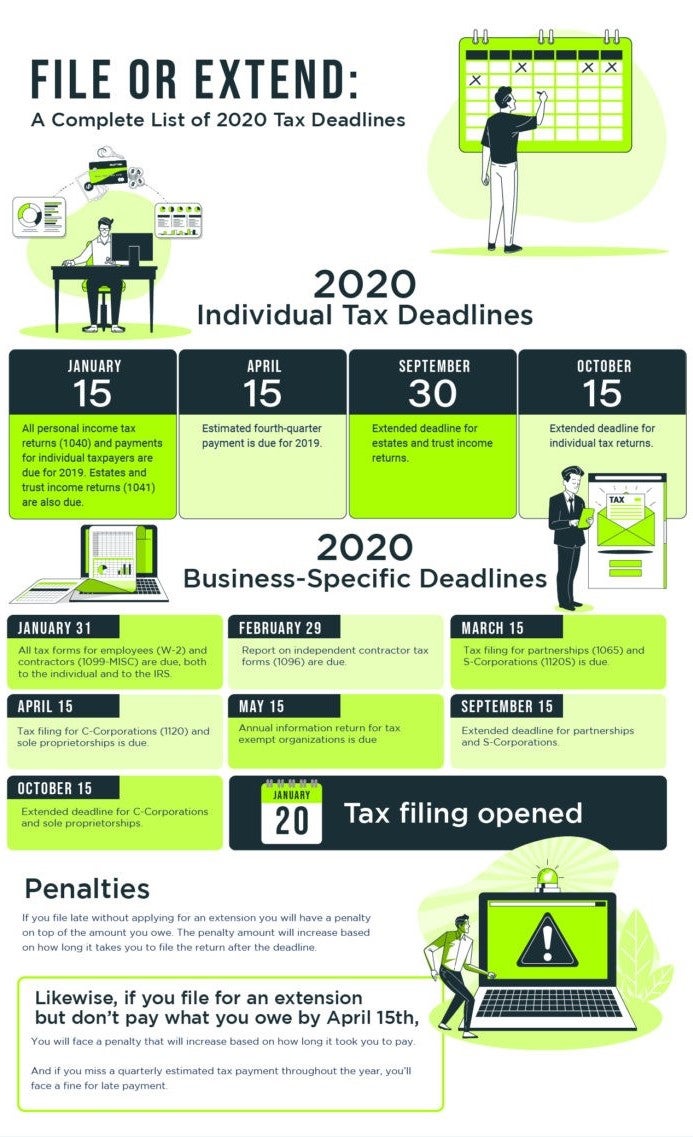

January 15th, 2020: Estimated fourth-quarter payment is due for 2019.

April 15th, 2020: All personal income tax returns (1040) and payments for individual taxpayers are due for 2019. Estates and trust income returns (1041) are also due.

September 30th, 2020: Extended deadline for estates and trust income returns.

October 15th, 2020: Extended deadline for individual tax returns.

Once you’ve finished dealing with the 2019 return, you may have to concern yourself with the quarterly tax deadlines for your payments in 2020.

April 15th, 2020: Estimated tax payments are due for the first quarter of 2020.

June 15th, 2020: Estimated tax payments are due for the second quarter of 2020.

September 15th, 2020: Estimated tax payments are due for the third quarter of 2020.

January 15th, 2021: Estimated tax payments are due for the fourth quarter of 2020.

When Are Business Taxes Due?

The tax deadlines for filing returns may be different for your business, although they vary according to the way your company is organized. Don’t assume that business-specific deadlines line up with your other tax due dates.

January 31st, 2020: All tax forms for employees (W-2) and contractors (1099-MISC) are due, both to the individual and to the IRS.

February 29th, 2020: Report on independent contractor tax forms (1096) are due.

March 15th, 2020: Tax filing for partnerships (1065) and S-Corporations (1120S) is due.

April 15th, 2020: Tax filing for C-Corporations (1120) and sole proprietorships is due.

May 15th, 2020: Annual information return for tax-exempt organizations is due.

September 15th, 2020: Extended deadline for partnerships and S-Corporations.

October 15th, 2020: Extended deadline for C-Corporations and sole proprietorships.

When Does Filing Open?

The United States Internal Revenue Service will open and begin receiving and processing tax returns on January 20, 2020. You can begin to file your tax return for the 2019 calendar year as soon as you have all the records together in January.

Get Organized and Stay on Top of Your Obligations

Just because you can wait until tax day in April to get everything in doesn’t mean you should. Filing earlier gives you time to make sure you do everything carefully and correctly. You’ll be able to get through the paperwork at a more relaxed pace and identify any problems or potential complications with plenty of time to spare. Efficient tax filing starts with organized bookkeeping every month of the year.

If you’re worried about your time management or you want to maximize your deductions and avoid paying unnecessary taxes, you might want to consider working with a tax professional. Tax law is complicated, and there’s no shame in acquiring outside help to help you close out your tax year.

The post File or Extend: A Complete List of 2020 Tax Deadlines appeared first on 1-800Accountant and is reprinted with permission.