Terry had a good job with an established software company but left to join a startup. Why? “Because they’re giving me startup stock options.”

Too bad. Two years later that job ended. That startup was going nowhere, cutting costs, and fighting extinction. Terry needed a new job. Again.

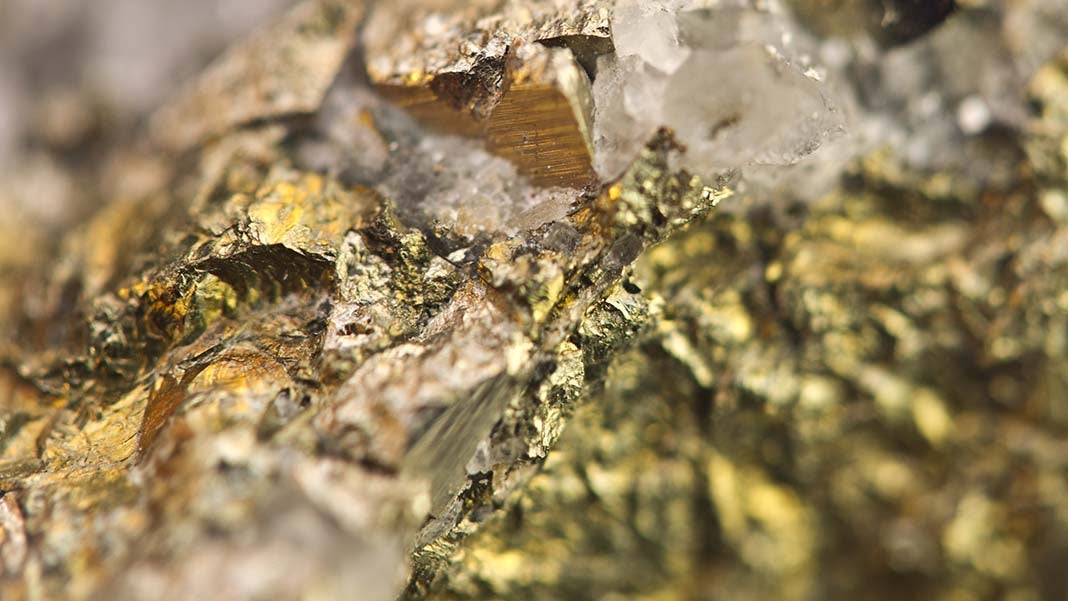

What about those options? They had no value whatsoever. They were a ticket for a lottery that had no prize and no winner. As likely as the pot of gold at the end of the rainbow. And Terry, influenced by options to switch jobs, made a bad decision.

Terry’s mistake is way too common in the world of startups and people working with high tech. Options cloud judgment. They are almost always worth way less than the psychological value we give them.

7 hard facts about stock options

Here are some hard realities about stock options for startups

- Stock options for an early startup will normally only have value if the company grows, prospers, and has a liquidity event later. Options for shares that are never publicly traded can’t normally be sold. They are a chance to join in sharing the pot of gold at the end of the rainbow, but only for the small minority of startups that make it that far.

- Options usually involve vesting: you get them over time, as you stay with the company. Vesting often takes four years, but can be any specified time. In the most standard four year vesting, you get one fourth of your options for every year you stay. Vesting means they are yours – the company can’t take them back.

- The number of shares is only half a number, meaningless without the other half. You have to divide that number of shares by total shares outstanding to calculate what percent of ownership is involved. A thousand shares is 10% of a company that has ten thousand shares outstanding, but only a thousandth of a company that has a million shares outstanding.

- The number of shares outstanding generally grows as a startup gets more investment. That’s called dilution. So an option for one thousand shares might be worth one percent ownership at the beginning when the company only has ten thousand shares outstanding, but those ten thousand can easily become a hundred thousand or a million later.

- Options have trigger prices to exercise. You have an option to buy; you don’t own them. You need to pay attention to the trigger price because that’s part of the value. Options for a thousand shares with trigger price of $1 per share cost $1,000. If the trigger price is $5, that’s a $5,000 purchase price.

- There are tax implications related to exercising options. The difference between the trigger price and the market price, at the time of exercising the options, was taxable at regular income tax rates the last time I looked (but check with an accountant; I’m not an accountant or attorney, so check me on my understanding). If you buy the options early, before they have real market value, your tax burden will be lower, but your risk higher. If you wait until the company gets liquidity (if it ever does) then your risk is much lower, but your tax burden higher.

- Most startups that raise venture capital investment are subject to so-called ratchet clauses that protect the investors from losing money band hurt the founders’ and option holders’ value. If the company achieves liquidity but for a market value less than what the venture capital investors put in, then they get all of that value first, before the others get any. You could have one percent ownership of a company worth $50 million, but get nothing if investors put in $75 million.

Get the stars out of your eyes

Stock options started decades ago as incentives for managers working in big companies whose stocks were traded on major public markets. The big publicly traded companies use them as incentive and reward. They give a manager options to buy shares at the current market value, so if the market value goes up, those options are worth money.

Stock options for startups, on the other hand, will only mean money if the startup is very successful. Even if the startup survives, grows, and prospers, the options might still be worth money if it doesn’t get acquired by a publicly traded company, or register and go public. Small shares of a healthy company that will remain privately owned forever, without a liquidity event, have almost no value to employees. They are better off negotiating salary and real benefits such as health care and vacations. Some companies whose use options to influence employees are, wither they intend to or not, giving them something equivalent to false gold.