How to Forecast Sales and Profits Without Just Guessing

By: Tim Berry

Yes, it’s—my title here—a real question, and I get it a lot: how to forecast sales and profits without just guessing. It’s a good question too, because it leads to a better understanding of how and why we use forecasting to help manage a business, and to predict starting costs and the numbers for the first few months of a startup.

It’s a corollary to the question, “But how can I forecast sales for a new product, when I have no data?”

And the key is that of course you guess. We’re people, we don’t know the future, so we are always guessing. But we’re not just guessing. We’re developing sets of assumptions. We’re looking at drivers for sales, realistic assumptions for expenses. We draw from experience as much as we can, and from research in addition. It’s a forecast, not a guess. And if it’s hard to forecast, sure; but it’s even harder to run a business well without a forecast.

Forecast Sales Based on Assumptions about Drivers

For example:

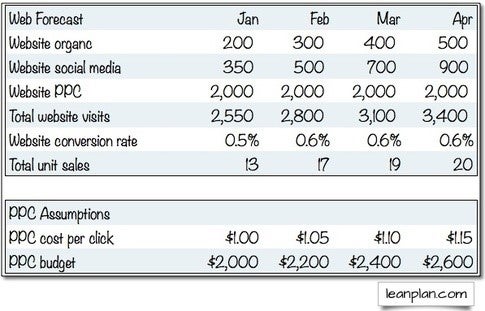

To forecast a web-based business you should probably consider traffic, drivers of traffic, plus conversion rates, and average unit sales per order. Drivers of traffic would include search engine optimization (SEO) for organic traffic, and pay-per-click (PPC) online marketing budget for paid traffic. Here is a simple example …

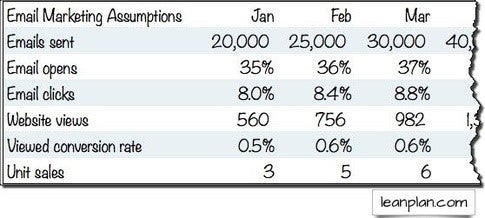

If your marketing includes email marketing, you can break the sales down according to emails sent, percentage opened, clicks to the web from email, conversion rates, etc. The illustration here is a simplified example.

If you are forecasting sales of an actual physical product, going through retail stores, then you should take into account reasonable expectations for distributors, retail chain stores, number of stores carrying it over time, unit sales per store, etc. And you’d want to have a good understanding of how margins work as you sell your product to distributors and they sell to retail stores. And you should be able to estimate the related expenses, such as stocking fees, co-promotion fees, and administration costs.

If you are forecasting sales of a mobile app, you’d want to look at sales through each of the mobile app stores, and develop assumptions based on history of similar apps, adjusted for your promotion strategies, marketing expenses, etc.

If you are forecasting sales with a direct sales organization selling to larger companies, you should understand a direct sales force, reasonable expectations of leads, presentations, and closes per month per sales person, pipeline dynamics related to decision time, etc.

Forecast Expenses Based on Reasonable Expectations and Estimates

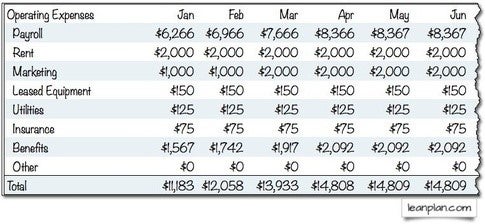

Estimates for expenses should include reasonable expectations on headcount, compensations per person, office space and logistics based on how many people and expected costs per square foot, infrastructure costs, and especially realistic marketing expenses.

Estimates of costs should take into account unit economics, economies of scale, production costs, etc.

These are just a few examples. Yes, it is guessing, but it’s also looking at drivers and assumptions and pulling the granular assumptions together so they are visible. And, furthermore, it’s supposed to be followed by regular plan vs. actual analysis, so the forecasts get steadily more accurate over time.