What You Need to Know About Invoice Financing

By: Wagepoint

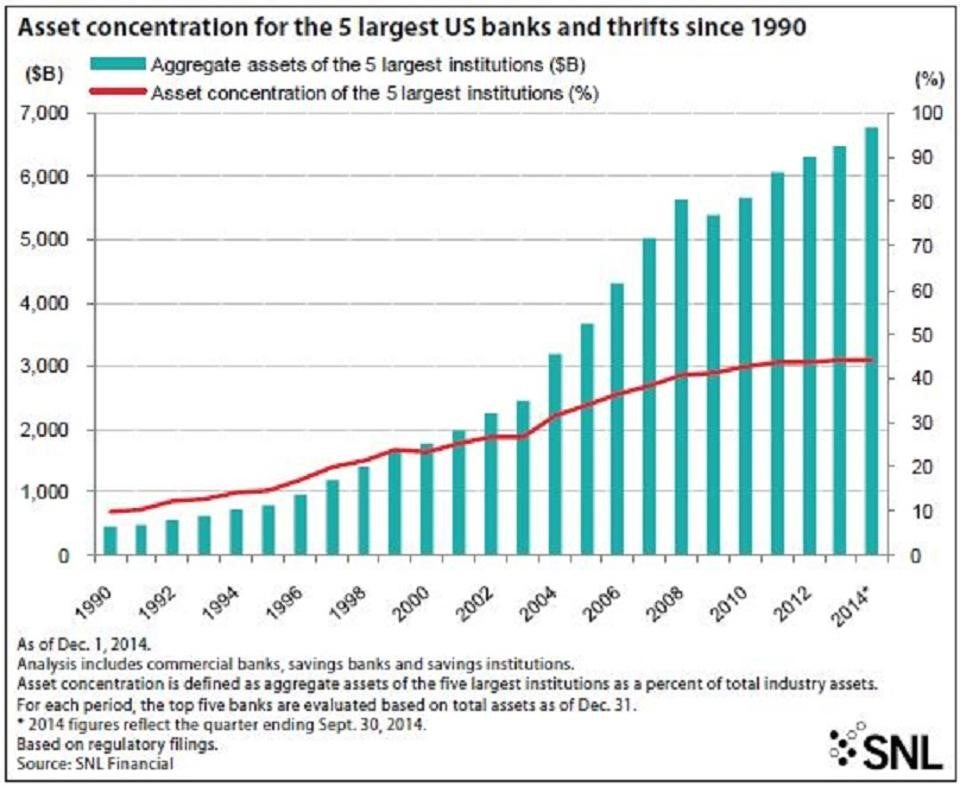

Banks have been in business for a long time and they have only gotten more powerful as they continue to consolidate their hold on the nation’s wealth. Even after the 2008 financial crisis, Forbes reported that 5 major banks held almost half of the U.S. banking industry’s financial assets—up 400% from the early 90s. The point: Banks are at the zenith of their power in terms of consolidation and their ability to avoid punishment for bad behavior. (Notice how no one has gone to jail for the 2008 recession?)

There’s a Chink Developing in the Banks’ Armor

There are a lot of financial technology (FinTech) companies that are freeing businesses that previously required banks to act as gatekeepers. For example, Dwolla makes automated clearing house (ACH) cheaper and more convenient for all kinds of third parties. Stripe has consolidated the payment gateway and merchanting into one service at a rate lower than traditional bank merchant accounts.

The Economist refers to collapsing role of traditional banks as “narrow banking.” The role of traditional banks will be reduced to “taking deposits and holding only safe, liquid assets.” FinTech companies will continue to eat away at the market share for small business lending as the cost of software development gets cheaper and cloud infrastructure becomes more secure. The transactional costs of underwriting and deploying funds is also more manageable for FinTech because any one company will usually only specialize in one type of lending.

The Internet is Cracking Small Business Lending Right Open

Nowhere is this trend more clearly defined than with invoice financing. It’s a tool that has been a go-to for bigger industries that consistently run short on operational cash, like telecom and transportation. But, it isn’t necessarily widely known among smaller businesses. Invoice financing is the future of cash flow management and a great option when thinking about how to get paid faster, because in many cases it’s cheaper than credit card processing.

The tendency to use invoice financing over credit cards is becoming more and more popular. Invoice financing companies are evolving to meet the needs of small businesses and there are great resources out there, like NerdWallet that compares these services.

Invoice Financing Can Be Less Expensive Than Credit Card Payments

Invoice financing allows you to get paid by the lender for the amount of the invoice within 1 – 2 business days, then pay back the amount of the cash advance over time rather than paying the typical 3% for the similar turnaround time.

A typical interest rate for invoice financing from companies, like FundBox and us, is somewhere in the .5% – .6% per week range. (We purposely priced ourselves lower than our competitors plus threw in free online accounting software.) This means, if you pay off an advance on an invoice within 30 days, you’ll end up paying 1% less than you would if you had gone through a credit card company. Invoice financing can also help you avoid expensive credit card fees, while still allowing your company to move forward with consistent cash flow.

Your clients might even take confidence in the fact that you are able to wait the 7 – 10 business days that it normally takes to write a check and mail it to you. (To understand how credit card processing fees end up adding up, read CardFellow’s article, “What are the Average Credit Card Processing Fees.”)

Also, ask any accountant at a big company and they would much prefer to send a check in the mail, as it’s a better paper trail than a credit card charge. This point is explained in more detail, along with a few other interesting points about checks in Bankrate’s article “5 Reasons Paper Checks Have Staying Power.”

Invoice Financing Isn’t Invoice Factoring

If you start looking into it more you are going to run into a lot more material about invoice factoring than invoice financing, but they aren’t the same thing. Invoice financing differs from invoice factoring in a couple substantial ways:

| Invoice Factoring | Invoice Financing |

| Only gives you upfront access to a percentage of the invoiced amount. | Gives you 100% of the invoice amount up front. |

| Involves selling your invoice to a 3rd party. | Is simply a loan based on invoices that you send out. |

| A 3rd party collects from your client directly. | Your clients never knows that you got payment assistance. |

Invoice Financing Easier Than a Bank Loan

The process of qualifying for invoice financing is less convoluted than borrowing from a bank. Instead of meeting with a loan officer in a brick-and-mortar location, invoice financing can be accessed online.

You will end up paying less in interest because you are only borrowing money that you expect to get paid shortly and not a larger amount that sits there until you need it. (All the while, paying the bank for the privilege of holding their money for them.)

Since invoice financing gives your business ready access to a credit line, you can get cash for your invoices within 1-2 business days of sending out a new invoice. The whole process can be automated by a software program that connects your and the finance company’s bank accounts.

The Typical Invoice Financing Application Process

The process of applying for invoice financing begins by completing an application. In order to complete this application, you may need the following (depending on the provider):

- Invoices that can be submitted for financing from creditworthy customers.

- Information about your company’s annual income.

- Information about your company’s history (i.e. how long you’ve been in business).

It is helpful to signal that your company is well established by integrating your bank account and enabling credit cards.

An Example of How Invoice Financing Works

Here is a practical example of when you might need invoice financing within your company and what the math would look like to use it.

Company A sends an invoice to Company B

Say you own a small manufacturing company, Company A, and you just sent out a $20,000 shipment of supplies to Company B. Rather than pay you in full right away, Company B agrees to the $20,000 in 30 days.

You need money now

While you can expect the $20,000 in 30 days, you need money in two weeks to pay your employees. From a purely accounting perspective, your invoice is a promise of a future payment and can be counted as an asset.

You apply for invoice financing

The invoice financing company acknowledges that you have an unpaid invoice of $20,000 (that’s your accounts receivable) and for that reason are willing to lend against that asset.

You get your money

Upon approval, the lender sends you the money within 1-2 days at a reasonable rate of .5% – .7% per week.

Repaying the loan

Let’s say the invoice financing company gave you a rate of .5% per week on your loan and they expect you to pay the loan back in 12 weeks. Given that .5% of $20,000 is $100, they’ll take the full 12-week period and add that to the principal for a total balance of $21,200. Divide that number by twelve and you get the weekly payment: $1,766.67. Assuming that you get paid by bank transfer, payments can be scheduled from your connected business bank account.

Fine print and other fees

Invoice financing companies generally have other additional fees, such as an origination fee—a one-time charge for the work it takes to underwrite your invoice financing credit limit.

Going back to the example above, if there is a 1% origination fee on the $20,000 limit, you’ll be paying $1,766.67 / week on a principal of $19,800 (the origination fee is usually automatically taken out of the loan amount before funds are issued). Knowing the true cost of your loan will lead to better financing decisions by weighing invoice financing against your second best option. Keep in mind that qualifying for a credit limit is different than financing because you only pay interest when you are using the money.

Knowledge is Power

Only you will know whether invoice financing is right for you, but you can’t weigh invoice financing against other financing options if you don’t know about it. In the immortal words of G.I. Joe: Now you know, and knowing is half the battle!

Author: Brad Hanks is over marketing at ZipBooks, online accounting software for small businesses. In his free time, he likes to fly his drone and get his daughters excited about math and science.

Author: Brad Hanks is over marketing at ZipBooks, online accounting software for small businesses. In his free time, he likes to fly his drone and get his daughters excited about math and science.