Budgeting and Personal Finance

10 Common Mistakes with Startup Financial Projections

I was glad to be asked about common mistakes with financial projections. I read about 100 business plans a year for angel investment and business plan competitions. Most show unrealistic profitability. More people doing business…

So, What If You Run Out of Money?

Money in the bank is like oil in the car. Certainly, you have many ways you are pulled every day, both tactical and strategic. But when money is the issue, your time, energy and focus…

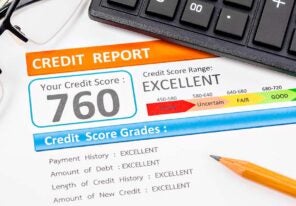

Your Personal Credit Score Matters More Than You Realize to Your Business

As an entrepreneur, it is assumed that you are aware that your business credit matters. It makes a difference in applying for loans, it affects your credit score, and improves your ability to apply for…

4 Keys to Successful Business Budget Management

Nothing about starting your own company is easy. Thankfully, when it’s just you and your partner, it’s fairly simple to monitor your spending and keep your budget in check. You’ll reach a point though where…

Why It Is Important to Keep an Eye on Your Cash Flow

If profits are up and the projections look good for the next month or two, should you kick back and relax? Maybe not. No matter how positive other signs may be, if you’re not keeping…

Avoiding Cash Flow Problems

Poor cash flow can affect much more than the financial performance of your business. The non-financial costs of poor cash flow can have just as negative an impact on your business as the financial costs….

Can Business Failure Damage Your Personal Finances?

This is a question often asked by entrepreneurs, and the short answer is maybe. The longer answer is that it depends on your circumstances and the type of finance you take out. If you’re a…

The Evolving Overseas Money Transfer Industry Helping Small Businesses

Small businesses that needed to make or receive international payments had to deal with high costs, extensive paperwork, and long processing times until not so long ago. This was when access to the institutional foreign…

Why Every Business Owner Should Have a Rainy Day Fund

Even if trading is very successful for your business, you can never be too sure of what dangers lie ahead. If your sales begin to dry up, running costs skyrocket or an unexpected expense messes…

5 Ways You Could Be Damaging Your Company’s Credit Score

Almost every small company needs to borrow at one point or another, and ideally sooner than later. And when you do, your credit score will dictate who does business with you and at what interest…